- News

- LIMA Global Licensing survey 2015

LIMA Global Licensing survey 2015

The latest trends within the global licensing industry

Last year, the global retail sales of licensed merchandise and services reached $241.5B, generating $13.4B in royalty revenue for the owners of the trademarks.

The Corporate Trademarks property segment turned out to be very sizable at 22.4% of total retail revenues, between entertainment and fashion.

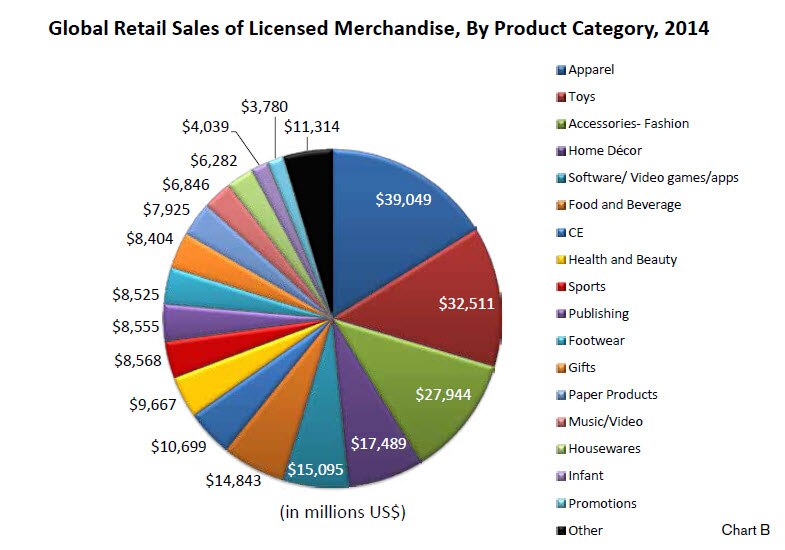

On the product side of the analysis, Accessories (11.6%) were within the clear leading retail revenue share categories of licensed products. The size of the Home Décor/Domestics Category which was driven by the success of some large direct to retail licensing programs was a very healthy 7.2% of the market and we expect this category to grow in future years.

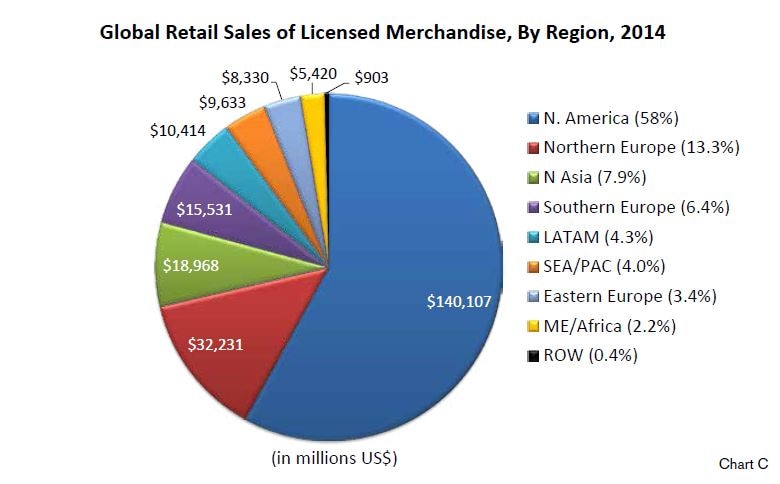

On a regional basis, North America is the dominant market for licensed goods, accounting for 58% of global retail sales, followed by Northern Europe (13.3%) and Northern Asia (7.9%).

The greatest licensing sales growth was reported in developing regions of North Asia and ME/Africa, while the slowest growth occurred in Europe as the region slowly recovers from its recession, which some of you might have experienced.

General trends

- When it comes to e-commerce, unsurprisingly, responses showed continuing rapid growth in on-line sales, with China in particular, accounting for 33% of retail sales of licensed goods, the highest in the world by a wide margin. India is likely to follow a similar path.

- Interestingly, as these digital segments continue to grow, they are making licensed products much more accessible to the rest of the world due to their ease of distribution in broadband connected countries. As a result of this phenomenon, North America’s share (58.0%) of licensed product sales in our study came in lower than many have previously thought, with additional share being spread to places like Europe (23.1%), Latin America (4.3%) and the Middle East/Africa (2.2%). Furthermore, we anticipate share in the Asia Pac region (11.9%), given its huge population, will accelerate significantly over time as these countries continue to develop economically and broadband connections become more widespread. We believe increased broadband connectivity will allow not only for more digital consumption, but also more on-line ordering of licensed products from b2b and b2c online sales portals.

- Respondents also talked about piracy of licensed goods being a “big” problem and “raging” in the Asia region, which certainly poses a significant risk to brand owners.

- Mass market price deflation is forcing the need to add more value into the licensed product feature set for the same price as generics to gain a point of difference. Brand licensing also was cited as a point of difference that can hold pricing steady.

- Food & Beverage Category brand licensing continues to be strong and many respondents spoke of – in the words of one – a “strong move toward better-for-you and organic brands.”

- As it gets more and more difficult for new licensed brands to get on-shelf at the major retail chains because of the retailers’ unwillingness to take risks on a property that is not a sure thing, more non-traditional channels are embracing newer licensed brands.

What are you thoughts on those results? Have you sensed those trends too?

You can download the full-survey at: http://www.licensing.org/news/lima-annual-global-licensing-industry-survey-now-available-for-download/#sthash.ogiY806z.dpuf